Home equity loan calculator usaa

Other rates and terms available. A home equity line of credit HELOC to decide which option is best for your financial goals.

A Href Https Www Mortgagecalculator Org Calculators Should I Refinance Php Img Src Https Www Mo Refinance Mortgage Refinancing Mortgage Home Refinance

It is hard to make an apples-to-apples comparison when it comes to loan requirements as USAA does not offer home equity loans only home equity lines of credit.

. A home equity loan and a HELOC are alike in that they are secured by your home the money can be used however you want and the amount you can borrow may be limited to 80 to 85 of your home. Please enter a minimum of three characters. Chart represents weekly averages for a 30-year fixed-rate mortgage.

It is more important than ever to check your rates with multiple. Home equity loan closing costs and fees. Our research analysts cover companies in nine highly focused industries across the market cap spectrum.

The Ascents Best Mortgage Lender of 2022. Mortgage interest rates have been volatile throughout the summer and. Todays national VA mortgage rate trends.

Construction-to-permanent or C2P loan. However their lines of credit are some of the most flexible in the industry. If a home costs 250000 and you need a 210000 mortgage to purchase it your loan-to-value ratio will be 84 since youre.

In most cases youre limited to borrowing a total of 85 of your home. Most lines have a 30 year payoff timeframe and you can borrow up to 70 of. Loan-to-value is the homes price divided by the mortgage amount.

This loan can be more. They stopped offering home equity loans in August of 2015 so the line of credit is your only option if you are set on working with Wells Fargo for your home equity product needs. USAA offers several types of insurance.

However their requirements for the lines of credit are about standard for the industry. Home equity line of credit HELOC calculator. In fact USAA tied as a winner of the Bankrate Awards for being the best auto and home insurance company overall based on Bankrates assessment.

Pricing may vary by state. Mortgage Calculator Found a home you like. Tax Credit Funds mobile login text.

Learn the ins and outs of a home equity loan vs. The average 30-year fixed mortgage rate rose from around 3 in December 2021 to 581 in June 2022 according to Freddie Mac. Historical Mortgage Rates A collection of day-by-day rates and analysis.

Home equity lender reviews. A combination of low fees several loan assistance programs and a wide selection of mortgage loans make Navy Federal Credit Union our best VA loan lender overall. Home equity loan rates.

It funds the land and the construction and then the loan converts into a permanent mortgage once the construction is complete. Bankrate compares thousands of financial institutions to make it easy for you to apply for the best certificate of deposit rate. Navy Federals standout feature are its low interest rates which.

The first is a standard home equity loan where you borrow a single lump sum secured by the equity in your home. Mortgage rates are at their highest level in years and expected to keep rising. The following examples describe the terms of a typical loan for rates available on Aug.

Although some lenders may reduce or waive them altogether home equity loan closing costs typically range anywhere from 2 to 5 of the loan amount. You can negotiate draw periods repayment periods periods of fixed interest and many other aspects of your loan. Calculate your monthly payment here.

Navy Federal Credit Union is a financial institution that offers low rates and financial incentives to military families. He has spent the last 5 years researching and writing about personal finance topics including student loans credit cards insurance and more. 11 2020 and subject to the assumptions described immediately above.

These are fixed-rate loans with terms of up to 20 years although you can get a lower. Note 4 If all occupying borrowers have not owned a home in the past three years and plan to apply for a USAA Federal Savings Bank 30-Year Conventional Loan with less than a 5 down payment at least one borrower on the mortgage loan will need to complete a free homebuyer education course online before closing. Third Federal Savings.

A VA Cash-out refinance loan may be right for those who want to trade their homes equity for cash. Home equity loan calculator. Jeff Gitlen is a graduate of the Alfred Lerner College of Business and Economics at the University of Delaware.

USAA allows you to borrow against up to 80 percent of your home value on a home equity loan minus whatever you still owe on your current mortgage. The advertised rates are based on certain assumptions and loan scenarios. Historical mortgage rates chart.

Home equity loans home equity lines of credit allow homeowners to borrow against a portion of their home equity while maintaining their first mortgage at its existing low rate. Bankrates proprietary research method revealed that USAA Clearcover and Geico are among. Home equity line of credit HELOC.

TransUnion published a study in 2017 which suggested there will be an average of 2 million HELOCs per year between 2018 and 2022. Property taxes insurances HOA fees and other costs associated with owning a home. Best Mortgage Lenders Independently researched and ranked mortgage lenders.

Raymond James equity research is a cornerstone of the organization. Current Mortgage Rates Up-to-date mortgage rate data based on originated loans. This mortgage calculator is intended to assist you with estimating.

Loan Requirements Because Wells Fargo does not offer home equity loans it is hard to assess them in terms of requirements compared to other lenders. Beware of the catch though. For today Wednesday September 07 2022 the national average 30-year VA mortgage APR is 5540 up compared to last weeks of 5270.

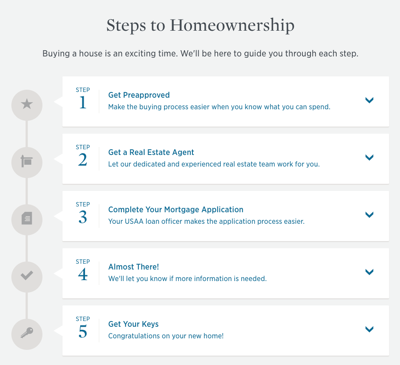

In exchange for an available cost reduction or waiver if you pay off and close the loan within a certain period usually three years you may. Your USAA loan officer makes the application process easier. Average for 2022 as of August 26 2022.

Additional restrictions apply to Texas home equity loans. Find the best CD rates by comparing national and local rates. A home equity calculator can provide a glimpse of how much you can borrow.

Why we chose it. Chase does not offer traditional home equity loans which makes them somewhat difficult to compare to other lenders.

Va Mortgage Calculator Calculate Va Loan Payments

Am I Eligible For A Va Home Loan Va Home Loan Eligibility

Usaa Mortgage Review 2022 Smartasset Com

List Of Documents For A Mortgage Loan Getting Into Real Estate Real Estate Terms Buying First Home

Va Loan For A Second Home How It Works Lendingtree

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Louisville Kentuc Mortgage Loan Originator Va Loan Home Loans

What Can You Buy With A Va Loan

10 Va Loan Myths Busted Home Loans Va Loan Loan

Veterans United Review 2022 Hero Loan Va Home Loans For Veterans And Military Families

/veteransunited-b0729646b8704c3d802b67aab5567c65.jpg)

Best Va Loan Rates Of 2022

Usaa Mortgage Review 2022 Smartasset Com

How Long Does It Take To Get Pre Approved For A Mortgage Credible

Basic Training About Va Loans Va Loan Loan Debt To Income Ratio

Usaa Home Equity Loan And Heloc Alternatives Lendedu

How To Read A Monthly Mortgage Statement Lendingtree

Tumblr Home Loans Usda Loan Usda

Am I Eligible For A Va Home Loan Va Home Loan Eligibility